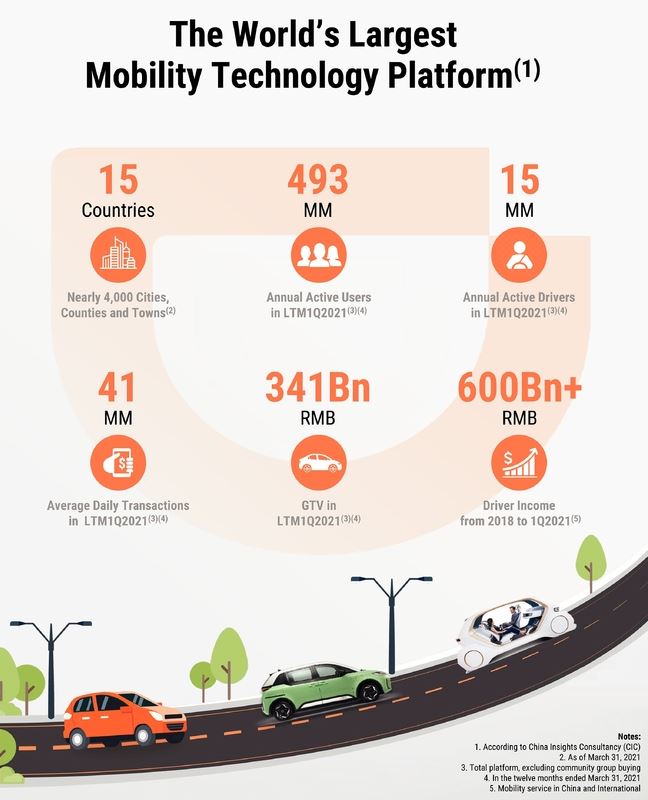

The book is covered multiple times by investors, two sources told Reuters on Tuesday.Īn over-allotment option, or greenshoe, exists where a further 43.2 million shares can be sold to increase the size of the deal.ĭidi was co-founded in 2012 by former Alibaba employee Will Wei Cheng, who currently serves as the chief executive officer. stock market.Ī total of 29 IPOs by Chinese companies in the United States in the first six months of the year raised $7.6 billion, the highest amount ever for that time period, according to Refinitiv data.ĭidi's IPO was covered early on the first day of the book-build last week and the investor books were closed on Monday, one day ahead of schedule. share sale by a Chinese company since Alibaba raised $25 billion in 2014, comes on the heels of record IPO activity this year, as companies rush to capture the lucrative valuations seen in the U.S. The listing in New York, which will be the biggest U.S. Didi did not immediately respond to a request for comment. The sources asked not to be identified ahead of an official announcement. This gives Didi a valuation of about $73 billion on a fully diluted basis. auditing rules.(Reuters) -Chinese ride hailing company Didi Global Inc raised $4 billion in its U.S initial public offering (IPO) on Tuesday, pricing it at the top of its indicated range, according to people familiar with the matter.ĭidi will sell 288 million American Depository Shares (ADS) at $14 apiece, the source said. regulations being rolled out that could see Chinese companies delisted if they do not comply with U.S. regulators will potentially gain more access to audit documents of New York-listed Chinese companies.Īnalysts also note the tougher stance coincides with new U.S. listing plans and opt for Hong Kong instead, with one source at the time citing Beijing’s concerns that U.S. In May, Reuters reported that Beijing was pressing audio platform Ximalaya to drop U.S. The tougher stance by the Cybersecurity Administration of China has been driven in part by concerns that the United States could gain greater access to data owned by Chinese firms – similar to concerns that the previous Trump administration had voiced about Chinese firms operating in the United States. later this year, a review of the filings showed. listings, Refinitiv data shows, well up from the $1.9 billion from 14 deals in the same period a year ago.Įight Chinese companies including home service platform Daojia Ltd and Atour Lifestyle Holdings have made public filings with the Securities and Exchange Commission (SEC) to list in the U.S.

So far this year, a record $12.5 billion by Chinese firms has been raised from 34 U.S. capital markets have been a lucrative source of funding for Chinese firms in the past decade, especially for technology companies looking to benchmark their valuations against listed peers there and tap an abundant liquidity pool. The three banks did not respond to a Reuters request for comment. Morgan Stanley, Bank of America, and China International Capital Corp Ltd (CICC) were the investment banks on the deal. LinkDoc did not immediately respond to a request for comment. The sources declined to be identified as the information has not yet been made public. The book closed one day earlier than planned on Wednesday, one of the three sources and a separate person said. It had planned to sell 10.8 million shares between $17.50 and $19.50 each. Article contentīacked by Alibaba Health Information Technology Ltd, LinkDoc filed for its IPO last month and was due to price its shares after the U.S. This advertisement has not loaded yet, but your article continues below.

0 kommentar(er)

0 kommentar(er)